As the

decentralized finance (DeFi) ecosystem continues to evolve, Solana has emerged as one of the most vibrant hubs for decentralized finance in 2025. Known for its speed, low fees, and rapidly growing developer community, Solana is attracting a new generation of DeFi users and builders seeking performance without sacrificing decentralization.

From decentralized exchanges (DEXs) to staking and restaking protocols, the Solana DeFi landscape is expanding fast. Whether you're a seasoned crypto user or just starting out, keeping an eye on the top Solana DeFi projects can help you navigate this fast-changing ecosystem and discover where innovation is happening.

Why Solana DeFi Projects Are Important in 2025

The DeFi landscape is undergoing a major shift, with

Solana emerging as a key platform for high-performance DeFi infrastructure. As traditional financial systems struggle with rising costs and limited accessibility, Solana’s efficient architecture and growing ecosystem are attracting developers, users, and capital at scale.

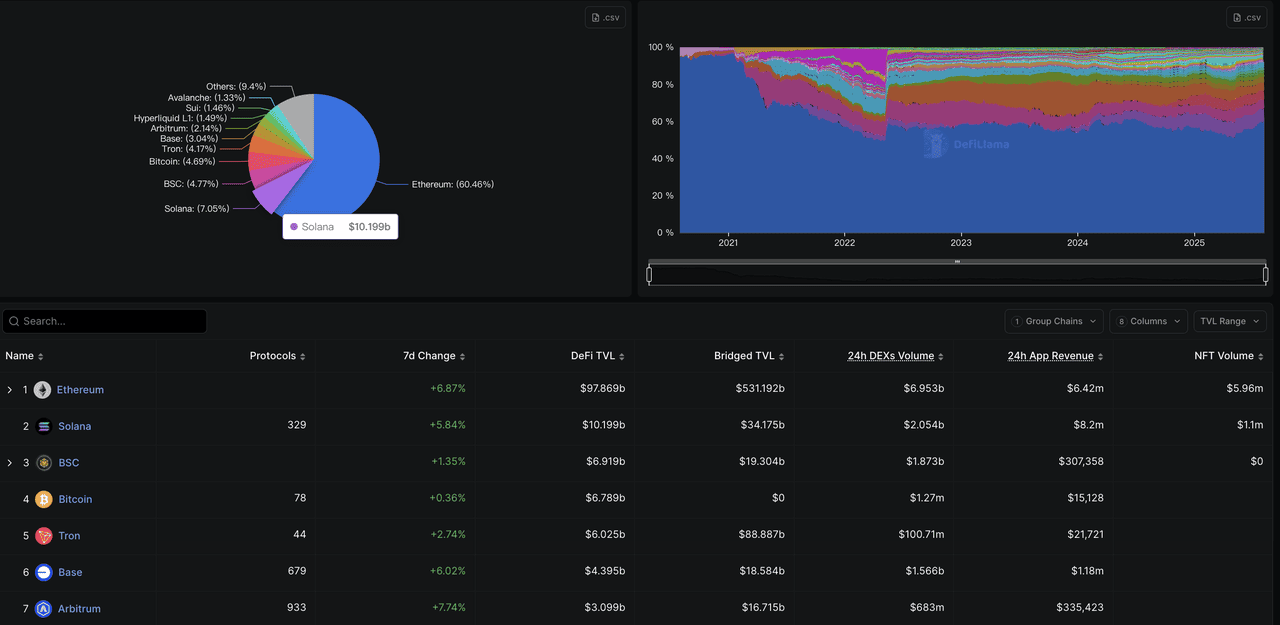

1. Solana as the Second-Largest DeFi Chain in August 2025

Solana is currently the second-largest DeFi blockchain by

total value locked (TVL), securing 10.2 billion dollars across its ecosystem. This represents 7.05% of the global DeFi market and places it ahead of

BSC,

Bitcoin, and

Tron. Its lead is driven by both technical reliability and an expanding base of applications.

The network supports over 329 protocols and has attracted more than 34 billion dollars in bridged assets from other blockchains, reflecting strong cross-chain demand.

Solana’s stablecoin market cap has surpassed 11 billion dollars, highlighting its role as a foundation for stable-value transactions across DeFi apps.

2. Institutional Adoption and the Rise of the Solana Staking ETF

With the global DeFi market projected to grow to 231 billion dollars by 2030, Solana’s current position offers room for continued expansion. Its infrastructure has already reached critical mass in protocol activity and developer adoption, supported by high throughput, low fees, and proven scalability. These advantages are now drawing attention from institutions that are beginning to

allocate SOL in their treasury strategies, viewing it as a performance-driven alternative to legacy crypto assets.

Confidence in Solana’s long-term value has also been reinforced by the recent launch of a

Solana staking ETF. By offering regulated exposure to SOL along with access to staking yields, the ETF marks a significant step toward mainstream institutional participation. Together, these developments reflect Solana’s evolution from a high-speed blockchain into a credible financial platform with growing relevance across both retail and institutional markets

Top 8 Solana DeFi Projects to Watch in 2025

Solana’s DeFi ecosystem has grown rapidly in both scale and complexity, with new protocols emerging across staking, trading, restaking, and liquidity infrastructure. Below are eight standout projects shaping Solana’s on-chain economy in 2025, each contributing uniquely to the network’s expanding financial stack.

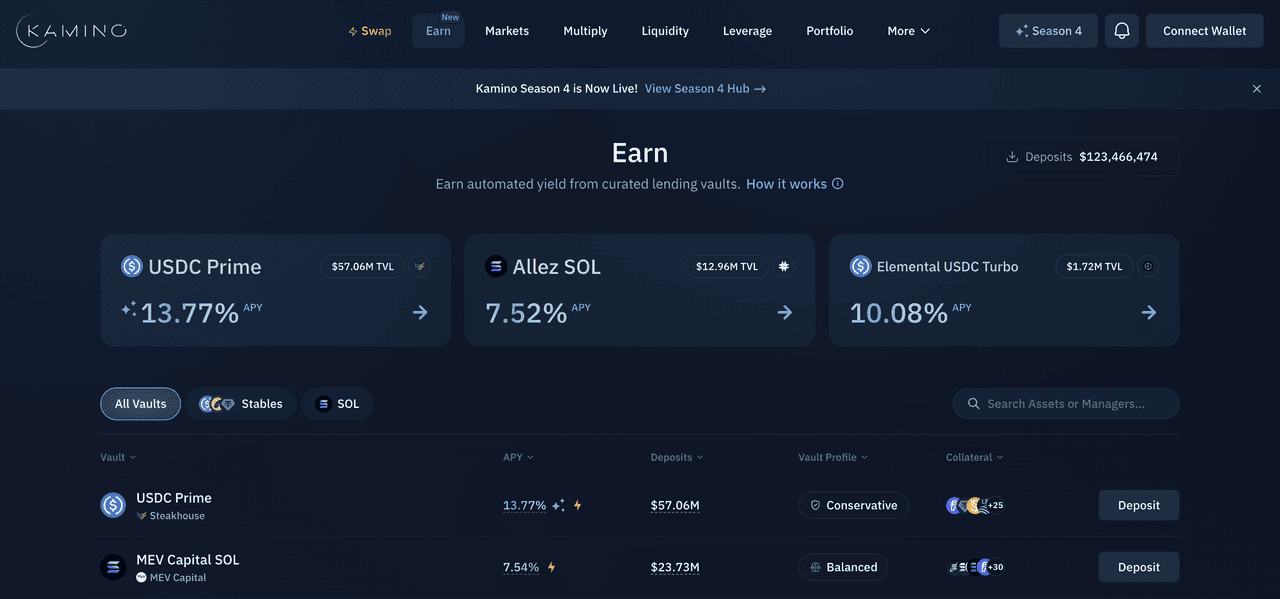

1. Kamino Finance (KMNO)

Project Type: Lending Protocol

The Solana lending market has experienced exponential growth since 2024, with total lending TVL increasing over 300% year-over-year as institutional adoption accelerates. Lending protocols have become essential infrastructure for leveraged trading strategies, with platforms handling billions in lending volume monthly. The sector has matured beyond simple lending to encompass sophisticated automated liquidity management and leveraged yield strategies, attracting both retail and institutional capital seeking optimized returns.

Kamino Finance (KMNO) has emerged as the leading lending protocol on Solana, offering a comprehensive DeFi platform that combines automated liquidity vaults with institutional-grade lending services. The protocol distinguishes itself through its innovative automated liquidity vaults (ALVs) that auto-rebalance concentrated liquidity positions, while simultaneously providing lending and borrowing capabilities with advanced risk management systems that have attracted over $1.6 billion in total value locked.

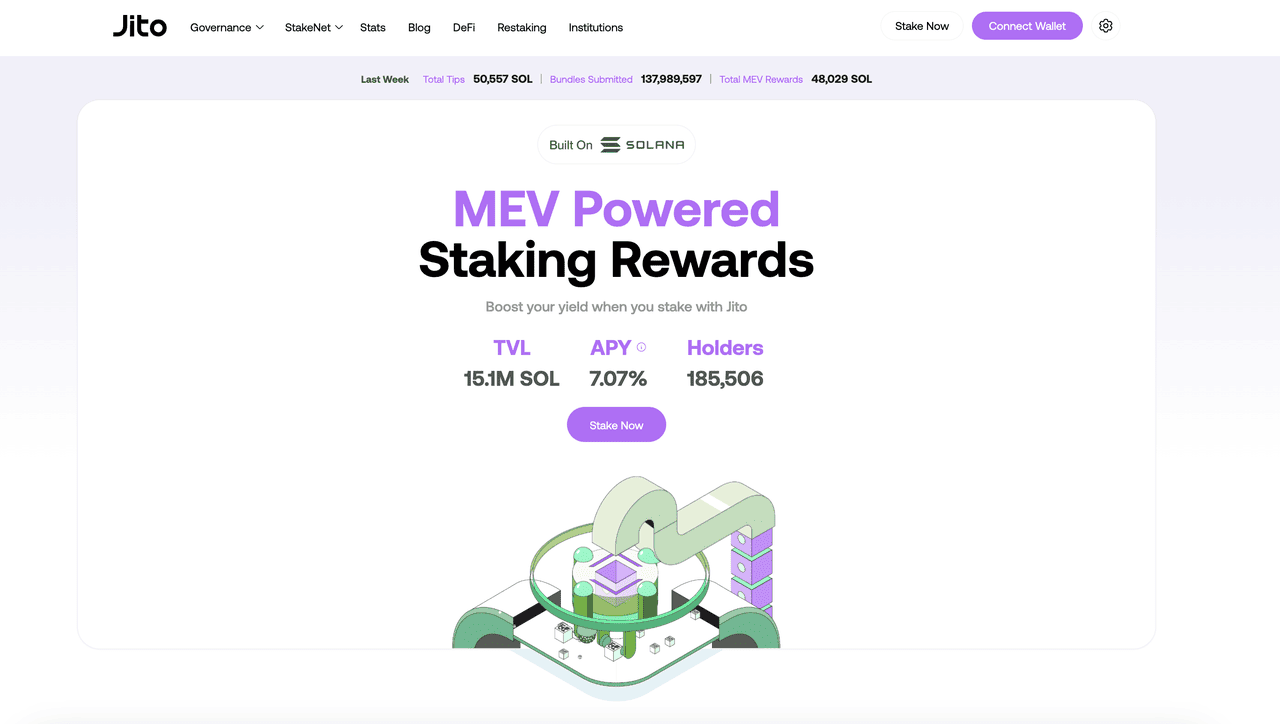

2. Jito (JTO)

Project Type: Liquid Staking

Liquid staking has transformed Solana's staking landscape, with the sector growing from virtually zero to over $3 billion in staked value within two years. The introduction of MEV-enhanced rewards has revolutionized yield generation, with MEV-enabled validators consistently outperforming traditional staking by 2-4% annually. The liquid staking market on Solana has achieved significant institutional adoption, with over 11 million JitoSOL tokens distributed across more than 650,000 accounts.

Jito (JTO) pioneered MEV-enhanced liquid staking on Solana, becoming the first protocol to combine traditional staking rewards with Maximum Extractable Value capture for enhanced yields. Users stake SOL and receive JitoSOL tokens representing their position while earning both consensus rewards and MEV profits through the platform's sophisticated validator network, which processes over 31% of Solana's validator operations and has consistently delivered superior risk-adjusted returns.

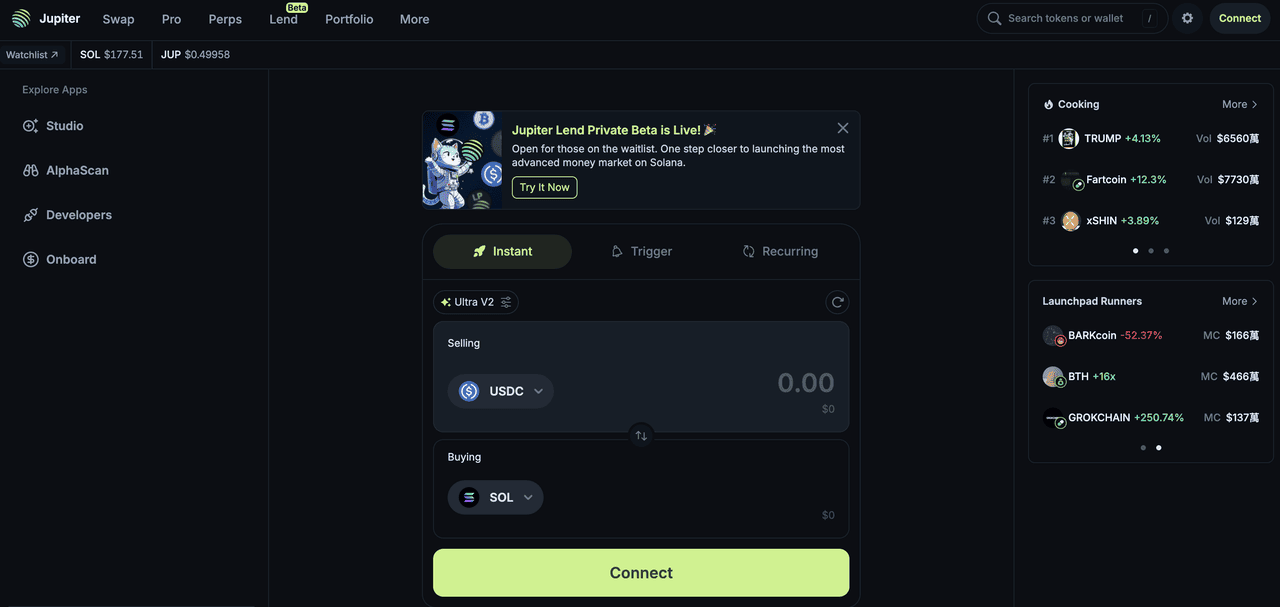

3. Jupiter (JUP)

Project Type: DEX Aggregator

DEX aggregation on Solana has evolved from a convenience tool to essential trading infrastructure, with aggregated volume growing over 500% since 2023 as the ecosystem fragmented across multiple exchanges. The aggregation sector now handles over $700 million in daily swap volume, becoming critical for optimal price discovery across Solana's diverse DEX landscape. Recent data shows that over 55% of all

Solana DEX trades are routed through aggregation platforms, highlighting their central role in ecosystem liquidity.

Jupiter (JUP) has transformed from a simple DEX aggregator into Solana's most comprehensive DeFi platform, expanding beyond swaps to include perpetuals trading, token launches, and portfolio management tools. The platform's sophisticated routing algorithms scan multiple DEXs simultaneously to ensure optimal execution, while strategic acquisitions including SonarWatch, Coinhall, and MoonShot have positioned Jupiter as a complete Web3 ecosystem serving millions of users with integrated financial services.

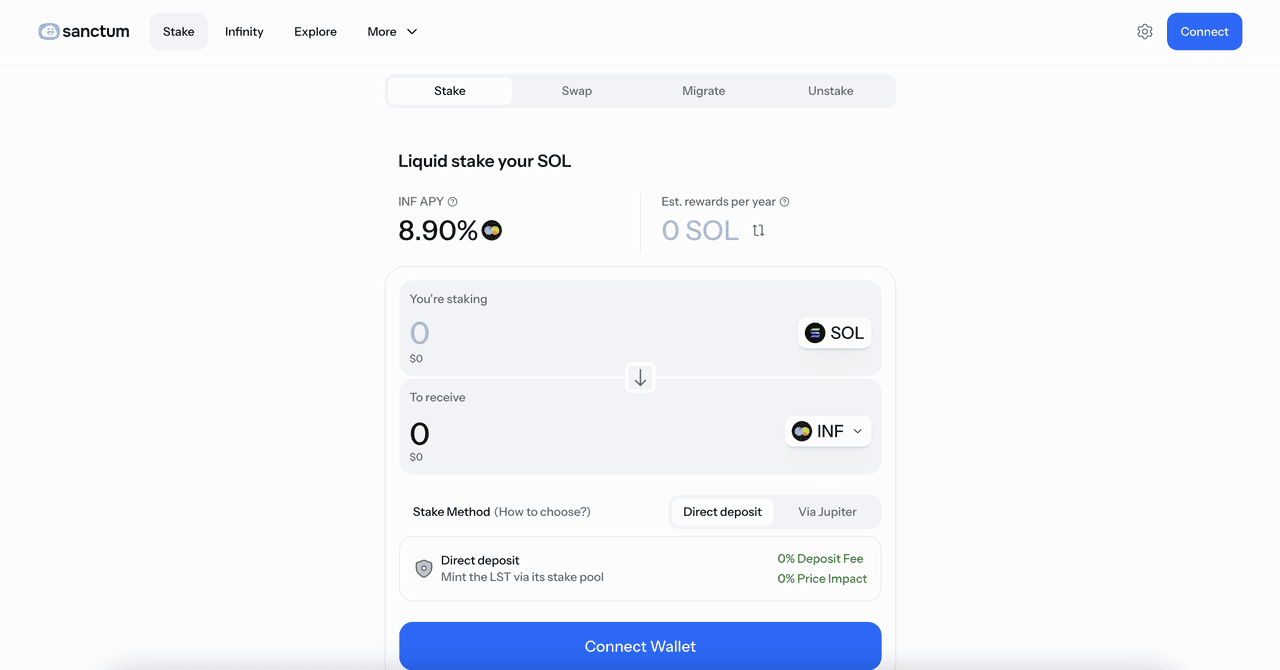

4. Sanctum (INF)

Project Type: Liquid Staking

The

liquid staking token landscape on Solana faces significant fragmentation challenges, with over 50 different LSTs creating isolated liquidity pools that limit capital efficiency. Historical data shows that LST-to-LST swaps often experience high slippage due to fragmented liquidity, with some trades showing 3-5% price impact on relatively small volumes. The sector has grown to represent over 10% of all staked SOL, yet lacks the unified infrastructure necessary for seamless interoperability between different staking solutions.

Sanctum (INF) addresses LST fragmentation by creating the first unified liquidity layer for all Solana liquid staking tokens, enabling instant swaps between different LSTs with minimal slippage through its innovative Infinity Pool mechanism. The protocol allows for custom LST creation while providing infrastructure for projects to use LSTs as delivery mechanisms for additional yields, subscription services, or governance rights, effectively creating an "infinite LST future" where any staking token can be traded efficiently.

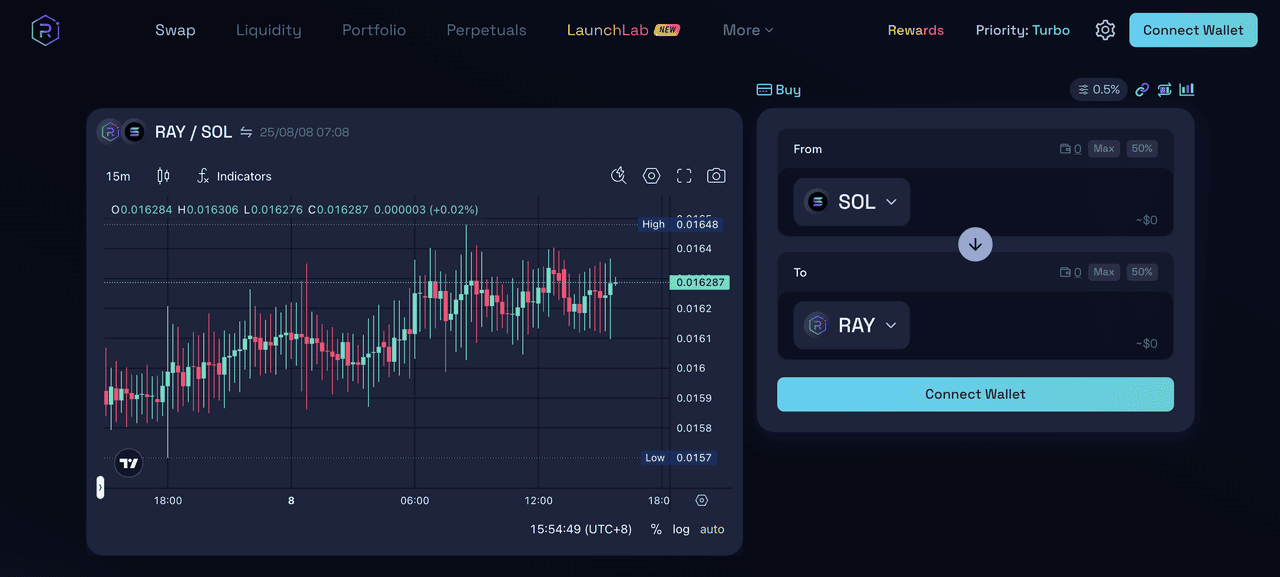

5. Raydium (RAY)

Project Type: Decentralized Exchange (DEX)

Raydium has maintained market leadership since Solana's DeFi emergence, consistently holding the highest TVL among Solana DEXs with over $1 billion in liquidity across multiple market cycles. Historical performance shows Raydium has processed over $500 billion in cumulative trading volume since launch, making it one of the most successful DEXs across all blockchains. The platform's integration with Serum's order book has enabled it to capture significant market share, often processing more volume than established Ethereum competitors despite operating on a smaller total market cap.

Raydium (RAY) serves as Solana's primary liquidity hub, uniquely combining automated market maker functionality with central limit order book integration for superior trading execution. The platform has established itself as the go-to infrastructure for both retail traders and institutional participants, offering concentrated liquidity pools, yield farming opportunities, and seamless integration with the broader Solana ecosystem while maintaining its position as the backbone of Solana DeFi.

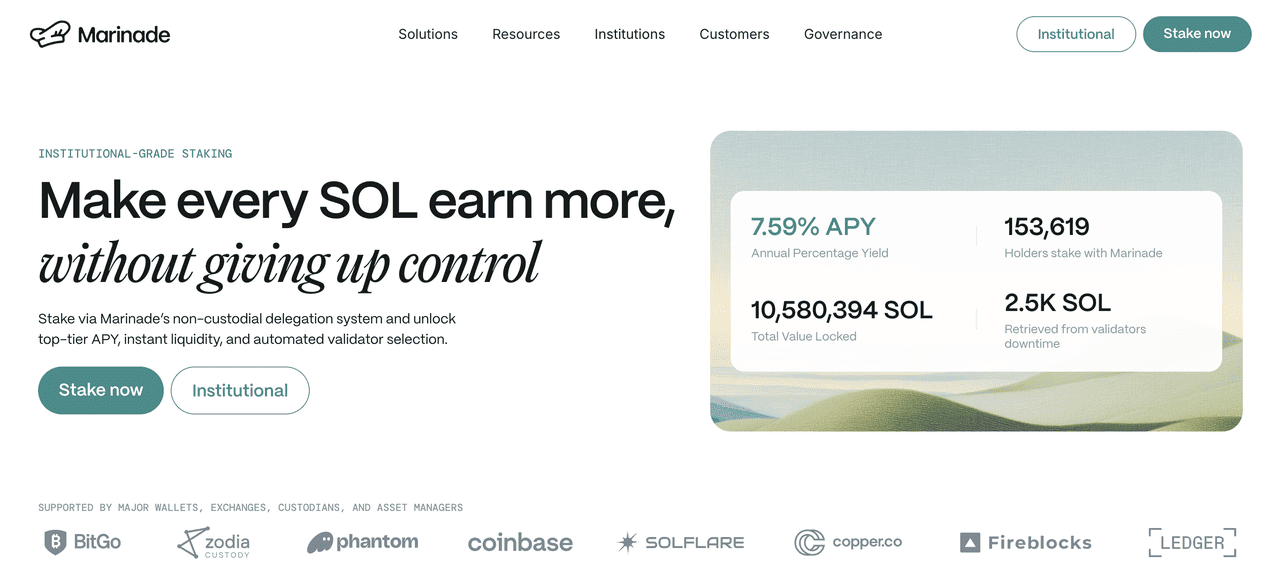

6. Marinade (MNDE)

Project Type: Liquid Staking

Marinade pioneered liquid staking on Solana in 2021 and has maintained its position as the ecosystem's most established staking platform with over two years of consistent operation. The protocol has staked over 6 million SOL cumulatively and distributed mSOL tokens that have become one of the most widely integrated assets in Solana DeFi. Historical data shows Marinade's validator selection algorithm has contributed to significant improvements in Solana's decentralization metrics, spreading stake across hundreds of validators rather than concentrating among dominant operators.

Marinade Finance (MNDE) operates as Solana's foundational liquid staking protocol, offering both liquid staking through mSOL tokens and native staking solutions that promote network decentralization. The protocol's sophisticated validator selection strategy automatically distributes stake across high-performance, smaller validators while providing users with liquid tokens that appreciate in value through accumulated staking rewards and can be utilized across the entire Solana DeFi ecosystem.

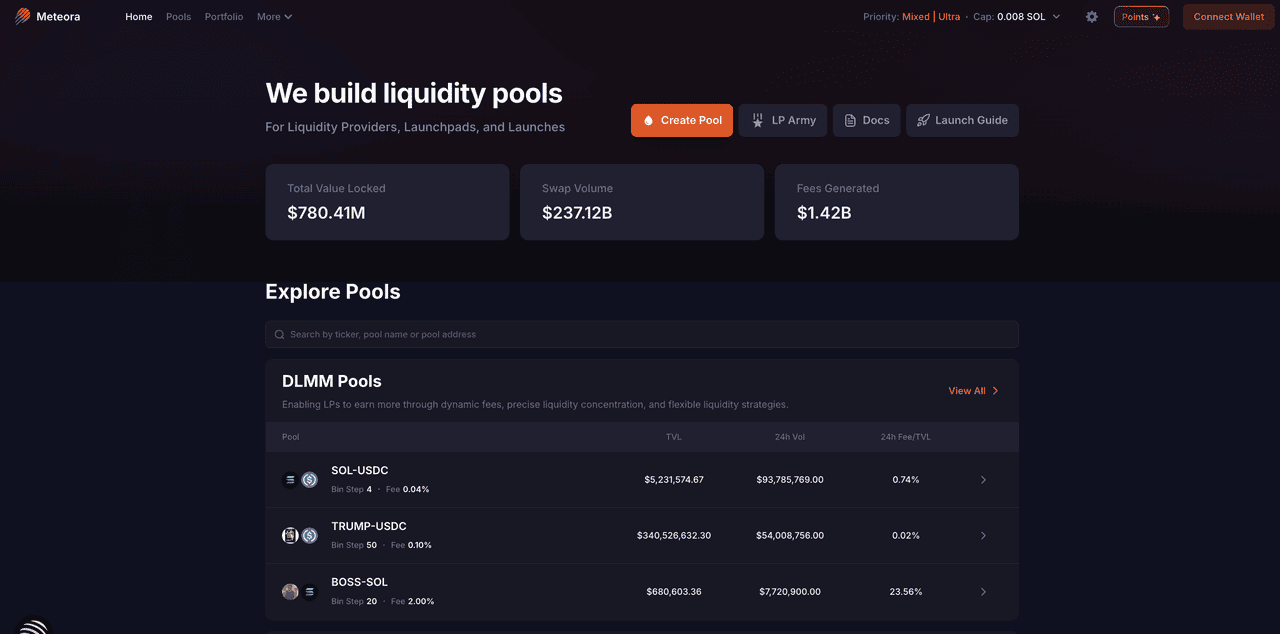

7. Meteora

Project Type: Liquidity Protocol

Dynamic liquidity management has emerged as a critical innovation in DeFi, with protocols utilizing automated market-making strategies experiencing significantly better capital efficiency than traditional

AMMs (Automated Market Makers). The sector has seen explosive growth with the rise of

memecoin trading and new token launches, requiring specialized infrastructure that can handle volatile assets while maintaining deep liquidity. Data shows that DLMM (Dynamic Liquidity Market Maker) protocols have achieved up to 50% better capital efficiency compared to traditional constant product market makers.

Meteora operates as Solana's premier dynamic liquidity protocol, specializing in automated market making through its innovative Dynamic Liquidity Market Maker (DLMM) technology that optimizes capital allocation in real-time. Despite being closely affiliated with the Jupiter team, Meteora functions independently and has rapidly established itself as the second-largest DEX on Solana by focusing on efficient liquidity provision for volatile assets, new token launches, and memecoin trading.

8. Orca (ORCA)

Project Type: DEX/AMM

Orca has distinguished itself in Solana's competitive DEX landscape by prioritizing user experience and accessibility, consistently ranking among the top three DEXs by user satisfaction metrics. The platform pioneered concentrated liquidity on Solana through its Whirlpools product, which has facilitated more efficient capital utilization and higher yields for liquidity providers. Historical data shows Orca has processed over $100 billion in trading volume while maintaining some of the lowest failure rates and highest user retention among Solana DEXs.

Orca provides an intuitive gateway to Solana DeFi with its user-friendly interface and innovative Whirlpools technology that enables concentrated liquidity provision for maximum capital efficiency. The platform has built a reputation as the most accessible DEX on Solana while offering sophisticated features including automated liquidity management, dynamic fee structures, and seamless integration with major Solana protocols, making it the preferred choice for both DeFi newcomers and experienced traders.

How to Trade Solana DeFi Project Tokens on BingX

Solana DeFi tokens are gaining momentum in 2025 as traders and investors look to capitalize on the growth of Solana’s high-speed, low-cost ecosystem. Tokens from leading projects such as

Jupiter,

Raydium,

Marinade, and

Orca are attracting attention due to their active usage across swaps, staking, restaking, and liquidity provision. BingX offers an all-in-one platform that makes it easy to access these tokens, combining centralized exchange features with AI-powered tools to

support smarter trading decisions.

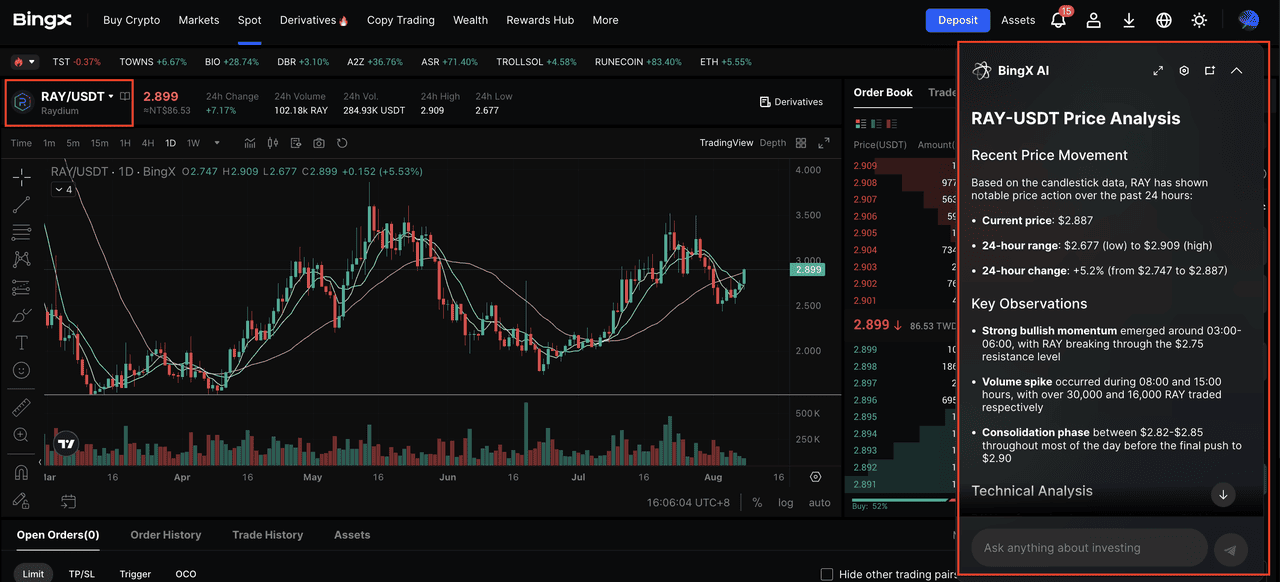

Use BingX’s All-in-One Platform with AI Assistance

Step 1: Find Your Trading Pair

Search for the token pair you want to trade (for example,

RAY/USDT or

JUP/USDT) using the BingX search bar. Choose Spot for simple trades, or switch to Futures for leveraged positions.

Step 2: Analyze with BingX AI

Click the AI icon on the trading page to access real-time market analysis from

BingX AI. The tool highlights recent price trends, support and resistance levels, and helps interpret market signals.

Step 3: Execute and Monitor Your Trade

Use a market order for immediate execution or a limit order to target your entry price. Continue monitoring BingX AI to adapt your position and strategy based on shifting market conditions.

Risks and Considerations Before Using DeFi Projects on Solana

While Solana offers speed and low fees, users should stay aware of the risks that come with any decentralized ecosystem:

1. Smart Contract Vulnerabilities: DeFi protocols rely on code, which may contain bugs or exploits. Audits help but don’t guarantee safety. Always review a project's security history before depositing funds.

2. Early-Stage Protocol Risk: Some projects may be new or untested. High yields often come with higher risk of failure or mismanagement.

3. Validator Centralization: Solana’s fast architecture uses a smaller validator set, which may raise concerns about decentralization over time.

4. Bridge and Cross-Chain Risk: Many assets on Solana are bridged from other chains. Bridge exploits or failures can cause loss of access or liquidity.

5. Regulatory Uncertainty: DeFi remains in a grey area legally. Changes in global regulation could affect access to or use of certain protocols.

Final Thoughts

Solana’s DeFi ecosystem in 2025 is defined by real usage, consistent growth, and expanding developer activity. With over 10 billion dollars in TVL and a strong presence across staking, trading, and restaking infrastructure, Solana has established itself as the second-largest DeFi chain by market share.

The eight projects covered in this article represent key pillars of Solana’s current DeFi landscape. They reflect how the network is evolving across core areas like liquidity, security, and composability. As the ecosystem continues to mature, these protocols are positioned to influence how decentralized finance is built and used on Solana in the years ahead.

Related Reading