In 2025, a wave of XRP cloud mining platforms is luring investors with eye-popping figures, contracts starting from just $10 and advertised returns of 100%–800% APR. These services claim you can earn daily payouts in XRP or Bitcoin without touching a mining rig, using XRP’s ultra-low fees ($0.0002) and 3–5 second settlement speed to fund BTC or ETH mining operations.

With XRP trading above $3.30 and riding momentum from regulatory wins and new use cases, the appeal is obvious. Yet, behind the marketing buzz, most of these schemes hinge on unverified operations, volatile token payouts, and business models far removed from traditional mining.

Understanding exactly how XRP cloud mining works, and where the risks lie, is crucial before sending your first transaction.

What Is XRP Cloud Mining and How Does It Work?

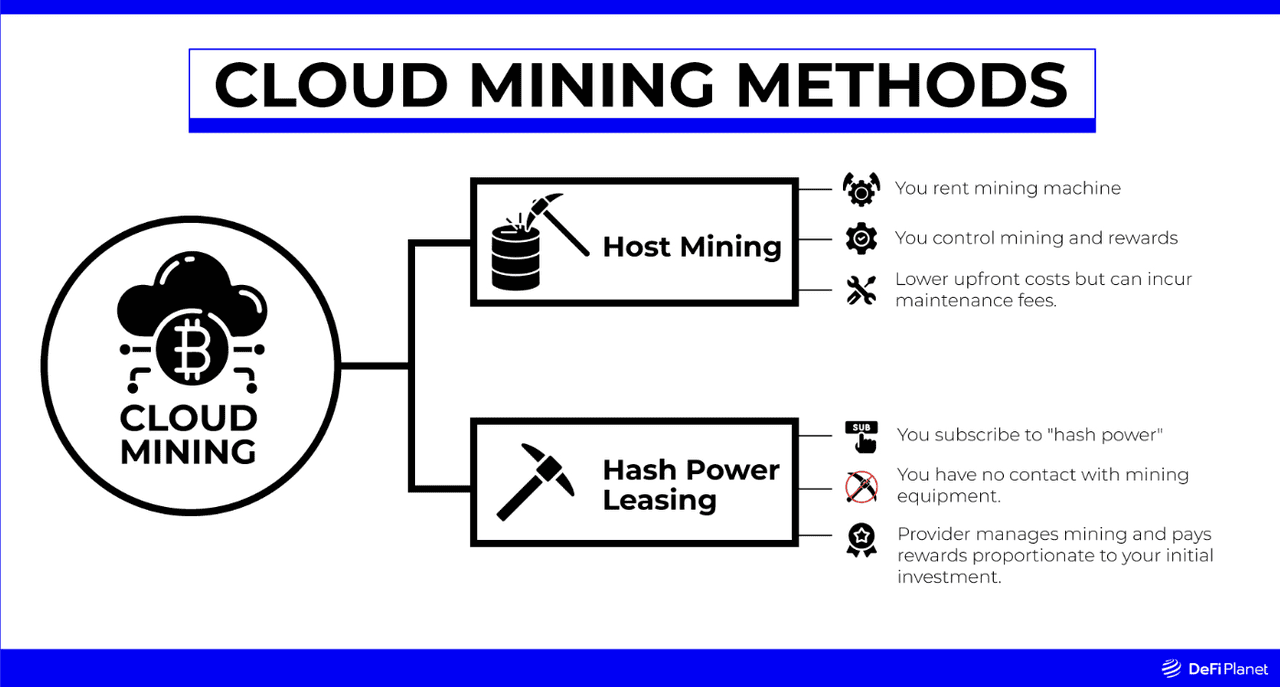

Despite its name,

Ripple (XRP) cloud mining doesn’t actually mine XRP. All 100 billion XRP tokens were created at launch in 2012 and are distributed through the XRP Ledger’s validator consensus system, not through energy-intensive

Proof-of-Work (PoW) mining like Bitcoin. This means there’s no way to “mine” XRP directly by running hardware.

Instead, XRP cloud mining is a financing model. Users deposit XRP into third-party platforms, which then rent computing power, or

hashrate, from large mining farms to mine Proof-of-Work coins such as

Bitcoin (BTC) or

Ethereum (ETH). The mined rewards are converted into your preferred payout currency, often XRP, BTC, or

USDT, and sent to your account daily.

Here’s why XRP fits into this model:

• Ultra-low transaction fees: around $0.0002 per transaction, making funding and withdrawing from contracts cost-effective.

• Fast settlements: typically 3–5 seconds, allowing users to start contracts and receive payouts almost instantly compared to slower blockchains.

• Low entry barriers: many platforms advertise contract options starting at just $10–$15, with durations ranging from 1 day to over a month.

For example, a user might purchase a $100 XRP-funded contract to rent hashpower for 5 days, with daily payouts credited to their account. The provider handles all the hardware, electricity, and maintenance costs, while the user simply chooses a plan and tracks earnings via a web dashboard or mobile app.

In short, XRP cloud mining leverages XRP’s speed and low cost as a payment and payout layer for traditional PoW mining, but it’s not mining XRP itself. Understanding this distinction is key for anyone considering these services.

How XRP Cloud Mining Contracts Operate

For beginners, one of the biggest attractions of XRP cloud mining is its simplicity and speed. There’s no need to buy expensive mining rigs, learn complex configurations, or manage electricity costs. Instead, you rent hashpower from a provider’s data centers and let them do the heavy lifting.

Getting started is straightforward:

1. Select a contract: Plans range from short 1-day trials to longer commitments of 30+ days. Contract lengths often influence daily payouts and overall returns.

2. Fund with XRP: Many platforms accept deposits starting at just $10–$15 in XRP, though some also support BTC, ETH, or stablecoins.

3. Start earning: Once the contract is active, the provider mines Proof-of-Work coins (e.g., Bitcoin, Ethereum, Litecoin) using industrial-scale equipment. Rewards are then converted and paid to you in XRP or another cryptocurrency, often within 24 hours.

Why XRP works well in this setup: Its 3–5 second settlement time and near-zero fees (~$0.0002) make it cost-effective to fund contracts and withdraw earnings without losing a chunk to transaction costs.

In practice, the whole process feels more like subscribing to a streaming service than running a mining operation: you pay a fee, gain access to a resource, and enjoy the output without ever touching the backend systems. This low barrier is what makes XRP cloud mining appealing, but also what can hide the true risks behind the glossy interface.

What Are the Top XRP Cloud Mining Platforms to Know?

Discover four leading XRP cloud mining platforms in 2025, their unique features, and how they use XRP to deliver daily crypto payouts without the need for mining hardware.

1. PFMCrypto: PFMCrypto is a fully XRP-integrated cloud mining platform where you can deposit, mine, and withdraw directly in XRP. Its standout feature is an AI-powered revenue optimization engine that automatically reallocates hashpower between Bitcoin, Ethereum,

Dogecoin, and other supported coins to capture the highest short-term profitability. This means your XRP funds are always directed toward the most lucrative mining opportunities, with daily payouts and principal returns at contract maturity.

2. XRP Mining (Mobile App): XRP Mining offers a mobile-first approach, turning your smartphone into a control center for managing cloud mining contracts. The mining itself is handled by global clean-energy data centers, so your phone is only used for monitoring and managing plans. With no technical setup required, you can choose a contract, track real-time earnings, and withdraw funds within seconds — all from a user-friendly iOS or Android app.

3. Ripplecoin Mining: Founded in 2017, Ripplecoin Mining combines AI-driven computing power scheduling with over 120 green mining facilities worldwide. Users can start with as little as $10 in XRP and earn automatic daily settlements. The platform markets itself as “zero-threshold mining,” with contract durations ranging from two days to nearly a month, catering to both short-term testers and longer-term participants.

4. BlockchainCloudMining.com: This platform emphasizes transparency and verifiability in its operations, publishing regular reports and connecting to blockchain auditing systems for contract validation. New users receive a small bonus contract to test withdrawals risk-free. With support for over nine cryptocurrencies, including XRP, BTC, and SOL, it appeals to users who want multi-asset flexibility alongside daily XRP payouts.

How Much Can You Earn From Cloud Mining XRP: Promised Returns vs. Market Reality?

One of the most striking aspects of XRP cloud mining in 2025 is the scale of its advertised returns. Many platforms promote short-term contracts with payouts that, when annualized, exceed 1,000% APR. For instance, a $100 contract might promise $3 per day over five days, a 15% gain in less than a week, while larger contracts claim multi-thousand-dollar daily earnings. These figures dwarf the yields from traditional mining or staking, making them appealing to newcomers seeking fast passive income. However, such high returns raise questions about their sustainability, especially in a sector with minimal regulatory oversight and limited operational transparency.

In contrast, established BTC cloud mining operations, such as those renting hashpower for Bitcoin via audited providers, typically generate a 5%–10% APR after costs, depending on market conditions and electricity rates. This gap suggests that XRP cloud mining payouts are either heavily subsidized by new deposits or rely on unconventional business models that may not be viable long term. While the marketing emphasizes low entry barriers and instant payouts, the economic reality is that consistently delivering such outsized returns without significant risk is rare in legitimate mining operations.

How to Earn XRP: Safer Yield Alternatives

For XRP holders seeking income with lower risk, several alternatives stand out.

DeFi platforms that support wrapped XRP can offer yields in the range of 5%–15% APR, often backed by

smart contracts and on-chain audits for greater transparency.

Proof-of-Stake (PoS) staking is another option, with Ethereum providing around 3% APY, Solana offering 6–8%, and liquid staking protocols like Marinade delivering 10–12%, all with clearer risk parameters than most cloud mining schemes. Additionally, regulated lending platforms and crypto savings accounts available on major exchanges can provide predictable yields under defined compliance frameworks, giving investors a more stable and transparent income stream.

How to Start Cloud Mining XRP

For those still interested in experimenting with XRP cloud mining despite its risks, following these steps can help reduce potential losses and improve your chances of a smooth experience:

• Start Small: Limit your first deposit to under $100 and test the platform’s payout process before committing more funds.

• Verify Legitimacy: Check for company registration, security partnerships, and user reviews before depositing XRP.

• Monitor Withdrawals & Lockups: Confirm withdrawal timelines and understand any lock-up conditions before purchasing a contract.

• Treat as High-Risk: Approach cloud mining as a speculative venture, not a reliable source of long-term passive income.

How to Trade XRP on BingX After Receiving Tokens from Cloud Mining

After receiving your XRP tokens, you can start trading by transferring them to BingX, which supports XRP across

spot trading,

perpetual futures, and

Earn products. This gives you the flexibility to buy, sell, or earn yield on your XRP based on your investment goals and market conditions. Whether you're holding for long-term appreciation or responding to short-term price movements,

BingX AI provides real-time insights to help you trade with confidence.

For a step-by-step walkthrough, check out our comprehensive guide How to Buy XRP.

Source:

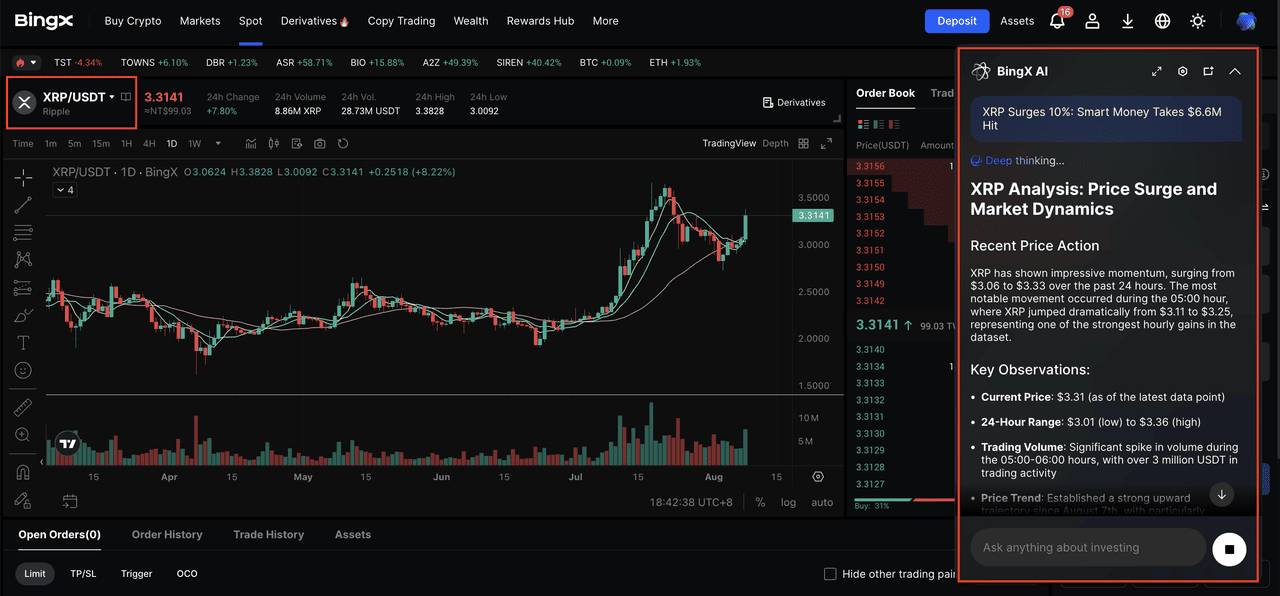

XRP/USDT Market Analysis Using BingX AI

Step 1: Search for XRP/USDT on the Spot Market

Open the BingX app or web platform, go to the

Spot Market, and type

XRP/USDT in the search bar. You can place a market order to buy or sell immediately or use a limit order to set your preferred price.

Step 2: Activate BingX AI for Real-Time Insights

Click the AI icon on the trading chart to activate

BingX AI. This feature analyzes price trends, highlights key support and resistance zones, and helps you understand short-term momentum so you can trade with more confidence.

Step 3: Plan Your Buy and Sell Strategies

Use the insights from BingX AI to spot ideal entry points for buying and exit points for selling. Look for reversal signals, breakout zones, and trend shifts to avoid buying at the top or exiting too early. Also, monitor XRP-related news, regulatory developments, and overall crypto market trends, as they can all influence XRP’s price.

With BingX spot trading and AI-powered tools, you can manage your XRP positions more effectively and make smarter trading decisions.

Key Risks of XRP Cloud to Consider

While XRP cloud mining offers a low barrier to entry and the promise of daily payouts, the underlying risks can be significant. Understanding these pitfalls is essential before committing any funds, as many issues only become visible once you’ve locked into a contract.

1. Unsustainable Yields: Advertised returns of 100%–800% APR are far beyond what is typical for legitimate mining operations. Such payouts often depend on a constant influx of new deposits, making the structure resemble a Ponzi scheme.

2. Platform Transparency & Credibility: A large number of XRP cloud mining platforms operate anonymously, have little or no operational history, and publish no verifiable audits. This lack of transparency makes it difficult to assess whether the business is genuine or sustainable.

3. Crypto Volatility: Even if payouts are consistent in XRP or BTC, sudden price drops can sharply reduce the fiat value of your earnings. Market swings can turn seemingly strong returns into net losses.

4. Hidden Fees & Lockups: Some providers deduct undisclosed maintenance fees, withdrawal charges, or enforce strict lock-up periods. These conditions can significantly reduce your net profit and limit liquidity.

5. Regulatory Void: Most platforms operate without licenses, third-party audits, or robust custody safeguards. In the absence of regulatory oversight, users face heightened risks of fraud, insolvency, or sudden platform shutdowns.

Conclusion: Should You Cloud Mine XRP?

XRP cloud mining in 2025 offers an easy entry point, minimal technical barriers, and the promise of daily payouts, making it attractive to newcomers. However, the combination of unrealistic return claims, limited transparency, and exposure to market volatility means the risks can outweigh the rewards for many investors.

For most XRP holders, safer yield strategies, such as DeFi with audited smart contracts, regulated lending platforms, or Proof-of-Stake staking, provide more stable, transparent, and risk-adjusted opportunities. As with any high-yield crypto product, it’s essential to conduct thorough due diligence, start small, and only invest amounts you can afford to lose.

Related Reading